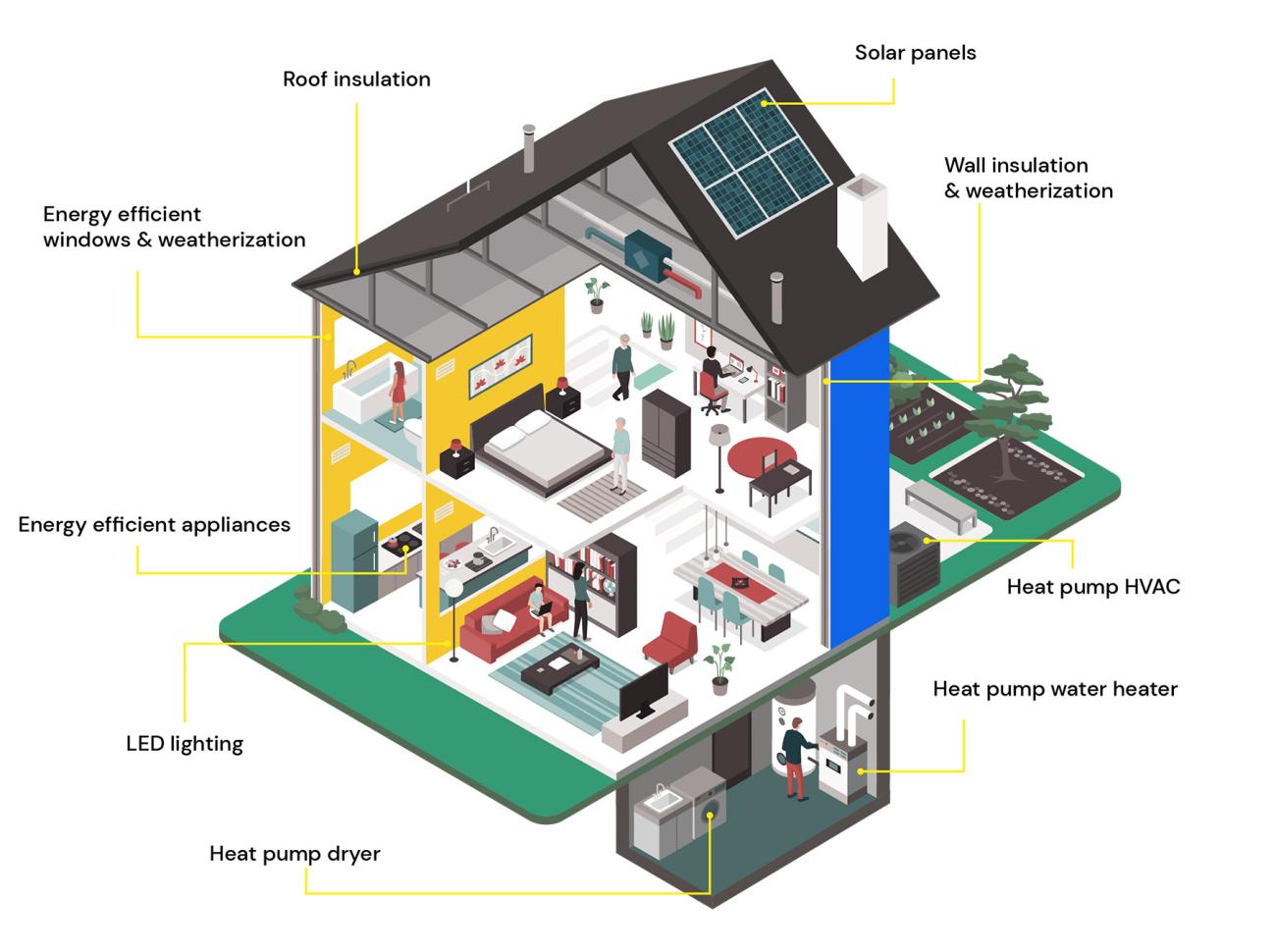

Actions for Home

SAVE MONEY WHILE MAKING YOUR HOME CLIMATE FRIENDLY

Financial support is available to help you heat, cool, insulate, and power your home, and switch to energy efficient appliances. You can often cut carbon while saving money on bills and being more comfortable at the same time.

INCENTIVES FOR A GREENER HOME

The Inflation Reduction Act (IRA) creates tax credits and rebates to directly help homes transition to cleaner technologies.

Heat Pumps

Federal Tax Credits

IRA tax credit 25C provides:

- 30% of your total project cost up to $2,000 for qualified heat pumps, heat pump water heaters, and other space and water heating technologies.

More information is available on the IRS website.

File form 5695 with your tax return

Maine Incentives

Efficiency Maine has programs to help with HVAC, weatherization, water heating, and more. Enhanced rebates for income-eligible households. Visit Efficiency Maine’s website, contact (866) 376-2463, or email info@efficiencymaine.com.

Weatherization Upgrades

Federal Tax Credits

IRA tax credit 25C provides:

- 30% of of your total cost, up to $1,200, for weatherization and building performance projects such as:

- insulation and air sealing

- door upgrades

- window upgrades

- energy audits

More information is available on the IRS website.

File form 5695 with your tax return

Maine Incentives

Efficiency Maine has programs to help with HVAC, weatherization, water heating, and more. Enhanced rebates for income-eligible households. Visit Efficiency Maine’s website, contact (866) 376-2463, or email info@efficiencymaine.com.

Rooftop Solar, Geothermal & Battery Storage

Federal Tax Credits

IRA tax credit 25D provides:

- 30% of all costs for rooftop solar, or investment in community solar

- 30% of all costs for geothermal heating

- 30% of all costs for battery storage

There is no cap on these projects.

File form 5695 with your tax return

Maine Incentives

Efficiency Maine rebates:

- $3,000 for qualifying home geothermal systems

- $100 per enrolled kilowatt (kW) per year for batteries

Electrical Panel Upgrade

Federal Incentives

IRA tax credits 25C and 25D both provide for electrical panel upgrades in conjunction with a heat pump or a solar installation:

- 30% tax credit up to $600 per year in conjunction with a heat pump

- 30% tax credit uncapped, in conjunction with rooftop solar

If both tax credits are applicable to your upgrades, choose the one that saves you the most money.

To view other ways to make your home more climate friendly, see our list!

Downloadable guide

Download our Mainers' Guide to Climate Incentives (PDF) to get all this information one place, including FAQs and a Getting Started Checklist.

Note: This booklet summarizes current incentives and tax credits available to Mainers through federal and state programs as of January 2025. Programs may change, so please check for updated information before making any purchasing decisions.